Slick onboarding, tech enabled solution. The team are always on hand to answer queries and you have real time report..

Slick onboarding & A Great Team

25 Apr 2023

Andrew Horbury

New account Submission

4 Apr 2023

Smooth process, easy to use and access, good service. Clear communications.

Nadine

24 March 2023

Super easy and efficient

The application it’s self was super easy considering I have never invested before. The team I have encountered so far have be..

Kelly Le Gresley

Rated 4.2/5 based on 7 reviews. Showing our 4 & 5 star reviews.

Introducing our portfolios

Preservation

Preserve Your Wealth, Grow Steadily: Our Preservation Portfolio is all about safeguarding your investments while aiming for stable growth. It's like having a reliable friend who helps you protect your money and achieve long-term financial goals.

Generation

Unleash Growth Potential: Our Generation Portfolio is designed for those who love seizing opportunities and chasing higher returns. We focus on exciting investments in innovative sectors that have immense growth potential. Get ready to watch your wealth grow over time!

Match your risk appetite: Choose between defensive (low), balanced (medium), and growth (high) risk, finding the perfect fit for your goals and how much risk you're comfortable with.

Choose wisely: Make a smart choice by aligning your goals with the level of risk that feels right for you. Your financial journey is unique, and we're here to support you every step of the way.

Investment Tips for Beginners

Start as early as you can! Time is your best ally in growing wealth. By beginning early, you benefit from compounding returns, reducing financial pressures, and giving your investments ample time to flourish.

Exercise patience and embrace a long-term perspective. Stay focused on your goals and avoid impulsive decisions. Building wealth takes time, and steady, well-informed choices will yield rewarding results.

Diversify well and stick with your strategy. Spread your investments across various assets to manage risk. Stay committed to your plan, avoiding emotional decisions during market fluctuations. Consistency and diversification build a strong foundation for long-term financial success.

At Spring, we understand that sometimes, only human support will do. That's why when you sign up, you'll be assigned your very own account manager. Take advantage of the human touch to help you navigate your investment journey with confidence. Invest effortlessly with the support you deserve!

Industry-leading customer service

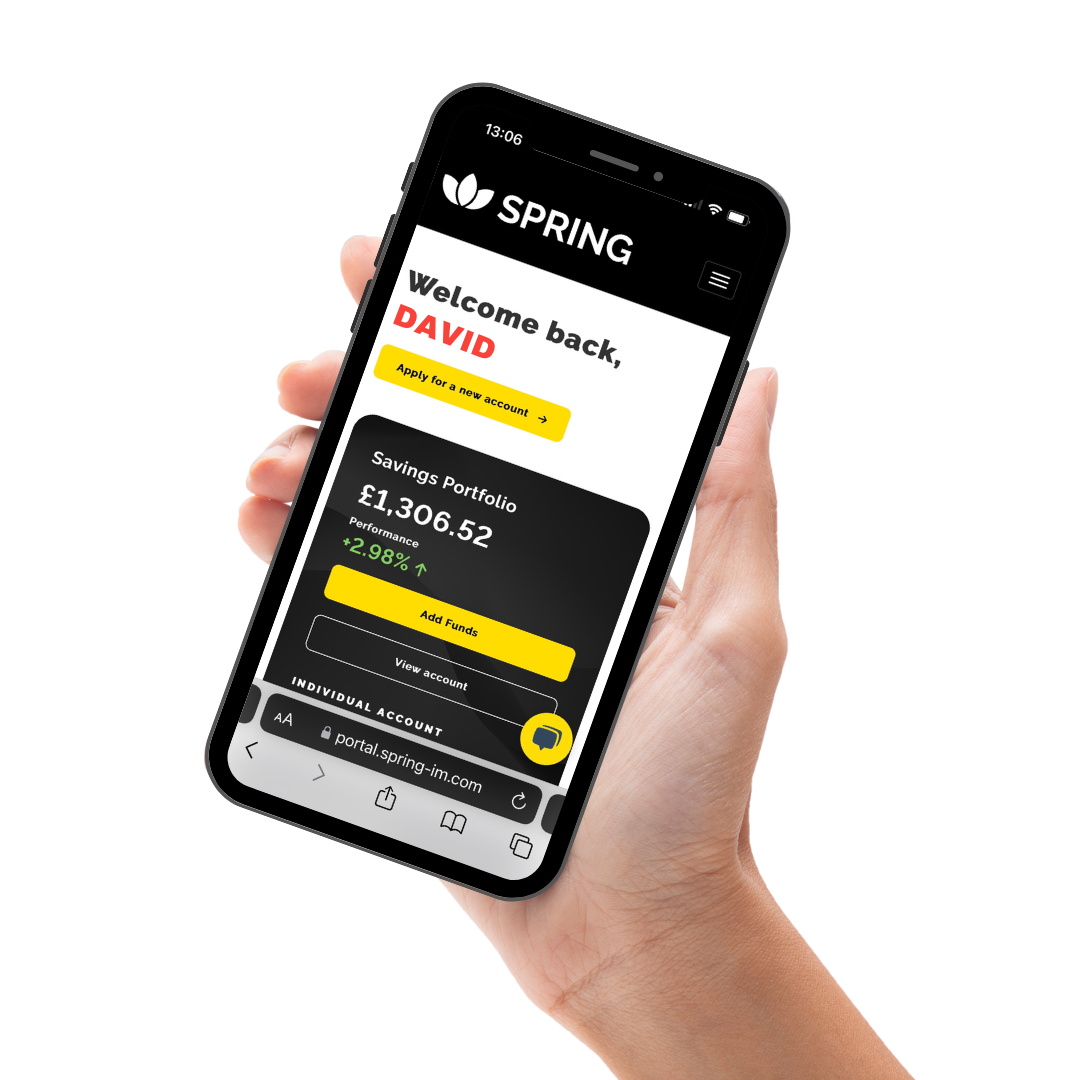

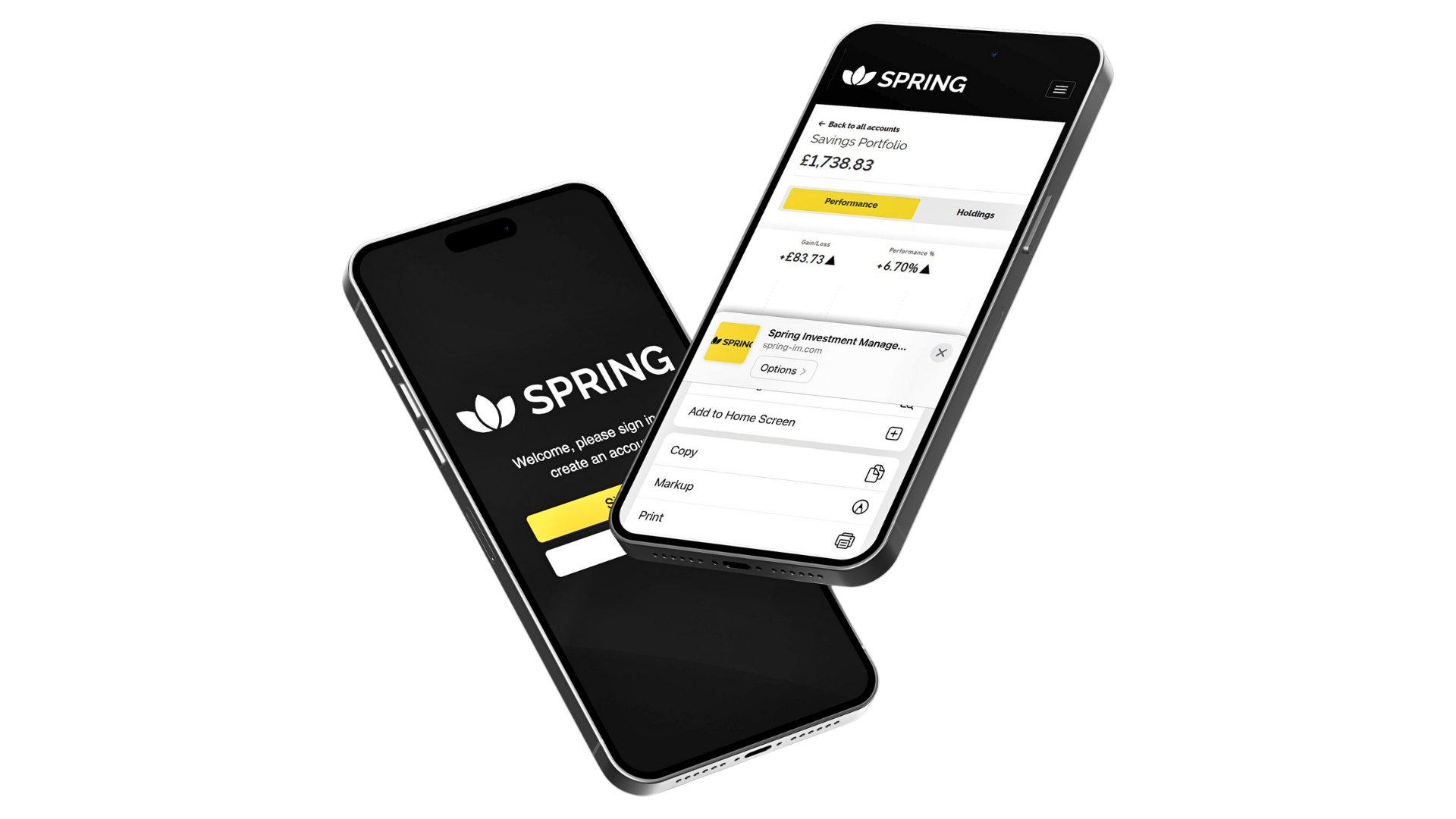

Effortlessly create an account in minutes with Spring. Simplified onboarding for seamless investment control.

Create an account in minutes

Contribute at a click

Effortless portfolio contributions. Simplified investing. Goodbye complexity, hello convenience.

Withdraw with ease

Easy withdrawals, seamless process. Access funds effortlessly when needed. Hassle-free, just a few clicks away

Have a question about Spring?

Get in touch with our friendly team

Call

+44 1534 473 5406

Monday - Friday: 9:00am-5pm

Hello@spring.com

Send us an email and we'll get back

to you as soon as possible

Chat

Click the icon on right

Speak to a member of our friendly

team now

Discover your Money personality

Ever thought about what kind of money personality you have? We like to think of it as being one of three types: The Saver, The Spender, or The Investor, each with its own unique money personality and way of handling cash.

The Saver: Savers prioritise building a safety net and are cautious spenders. Their conservative approach often leads them to favour low-risk investment options, that protect their hard-earned money.

The Spender: Spenders enjoy living in the moment and tend to indulge in their desires. As investors, they might be drawn to high-return, high-risk opportunities, seeking greater gains.

The Investor: Investors are strategic planners, seeking long-term growth and financial security. They diversify their portfolio, combining both high and low-risk investments to achieve their financial goals steadily.

Knowing your money personality can significantly impact your investment portfolio options. It helps tailor investment strategies that align with your financial habits and goals. Our experts are here to guide you in exploring the best investment choices for your unique money personality. Discover more about your financial style and start making better investment decisions today.

Insights from the Experts

Read the latest pension news and retirement planning tips, from our collection of personal finance journalists, investment professionals and money bloggers.

You put in £1000, the bank pays you say 2% per year and at the end of the year you’ve earned £20…

24 July 2023

By Spring

Investment Basics

Recent technology stock gains have been driven by the potential for AI, and how transformative…

By Spring

03 July 2023

Investment Basics

Spring’s children’s investment accounts put you in control. We’ll do all the legwork, but you retain…

By Spring

12 March 2023

Investment Basics

Contact us

Address

1st Floor, Spring Investment Management Limited, 9 Castle St, St Helier, Jersey JE2 3BT, Jersey

Start investing with Spring. It takes just approximately 15 minutes to sign up.