Commodities

Is the Old Economy the New Opportunity?

Long term shifts in supply, a misunderstanding of demand patterns and historically low inventories are the building blocks for the next commodity super cycle – provided you know where to look.

With China displaying rather weak economic activity recently, one might begin to question the argument for investing in commodities. Let’s do a deep dive into two commodities specifically, to understand some of the forces at play.

Oil

The price of oil has been on a roll of late, with the price of West Texas Intermediate (WTI) above U$80/bbl and its 200-day moving average (Chart A). So why has this happened and what’s the outlook for the rest of the year?

A good starting point I like to use is to think of the oil market as a triangle – with demand, supply and inventory as the three drivers of the price.

Except that in the short term, it’s all about demand, or rather, the perceptions of demand, which is the most influential driver. By the latter I mean the financial market for oil, rather than the physical market. The spot price for oil is influenced mainly by non-market participants, who care little for, as an example, the latest data on US diesel demand, and are more concerned about larger macro factors. For instance, they may be focused on whether interest rates are going up, or a stronger US Dollar, or weaker macro data. If so, they decide to go ‘short’ on oil. In fact, this financial market for oil is so much bigger, and more influential, than the physical market. The ‘bear market’ we saw in the price of oil in first half of 2023 was a manifestation of these fears, and not a reflection of the true fundamentals in the market for oil. Yet it’s these fundamentals that we are interested in.

Demand for Oil

Markets seem to fret over the US demand for oil, but frankly, this shouldn’t matter. US demand is fairly static, it’s broadly been the same as it was 20 years ago, and with every year that passes US demand becomes less and less important to overall global demand. But if we’re going to be concerned about US demand, it would actually make more sense to look at the data. Covid and lockdowns helped to distort the numbers recently, but demand is positive again (Chart B).

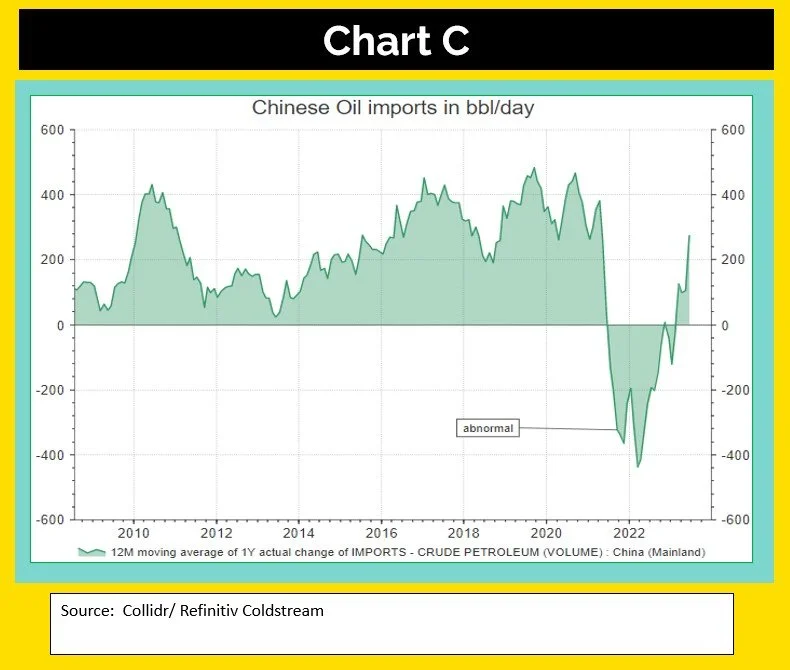

Next, one might think that overall global demand is in decline, what with net zero, electric cars and all. However, that’s a very western-centric viewpoint, more London than Lagos in its assessment. In fact, it’s normal for global oil demand to rise each and every year, despite ‘net zero 2050’, the ‘electric vehicle revolution’, etc. What drives global oil demand is what’s happening in Asia and Africa, where oil demand (and, unfortunately for us all, CO2 emissions) continues to grow strongly. It would take a global recession, or another pandemic, to turn global oil demand negative. And despite demand for oil drying up in China last year due to Covid lockdowns, last month we witnessed the biggest one month increase in Chinese oil imports EVER. Their rolling annual demand has turned positive again (Chart C).

With this in mind – consistent US demand, strong global demand, China back in the market– one might be very bullish on oil, based on ‘demand’ factors.

Oil Supply

Last year, faced with soaring oil prices (driven by the fear of a collapse in Russian production) as the US headed into the mid-term elections, President Biden opened the tap and released a huge amount of oil from the US strategic reserve (SPR), and continued with this even when the price of oil price fell sharply. At the time, he promised to replenish the reserve when prices normalised. To date, we’re still waiting for that to happen. At the peak of the release, it was equivalent to 1 million bbl/day, a huge impact on the global demand/supply balance. The scale of the SPR release was unprecedented. What does Biden do next time oil prices start to rise aggressively? Once the oil has left the SPR, it’s gone.

With this US release, surprisingly resilient Russian production (while Western sanctions may appear tough on paper, they’re not being vigorously enforced), and China’s diminishing demand, oil prices were relatively depressed for much of the second half of 2022.

Meanwhile Saudi Arabia (who have had their conflicts with President Biden) were apoplectic, even more so when they started cutting OPEC production in response, with President Biden accusing them of manipulating the market. Saudi Arabia wants and needs the price of oil to be U$80 and have aggressively cut OPEC production this year in response to the market surplus that had then evolved. But the reasons for that surplus are no longer present, so we’re heading for a market deficit.

Can US Shale come to the rescue? For a whole host of reasons, that’s simply not going to happen. The best shale fields have been worked out, capital discipline and shareholder pressure mean it’s all about cashflows and not production. While in recent times US Shale growth may have gone a long way to meet global demand, not anymore. US production growth is slowing to a crawl. And what happens if those Russian sanctions finally start to have an impact?

With no more SPR release and US output growth slowing, OPEC is once again able (and determined) to influence the price of oil. Looking just at supply, one might be rather bullish on oil.

Inventory

Inventory is the least understood, most opaque, and often less important factor …until it suddenly does matter. A lot of inventory data is murky, e.g. oil held in tankers at sea. What we do have is reliable weekly US inventory data, it normally comes out at 3.30pm every Wednesday.

However, one needs to ignore these weekly changes and the so-called market estimates, for the only sensible way to view the data is in terms of the annual change. The following chart (Chart D) is all you really need to know about inventory. This is the physical annual change in inventories, expressed in millions of barrels.

If you look at Chart D, it includes the Strategic Petroleum Reserve (SPR). When that’s included, you can see gross inventories are significantly and persistently lower than the previous year, which has been the pattern since early 2021.

So, once you account for the SPR, then the inventory picture is chronically low, and given the trends we have outlined in demand and supply, they’re likely to go even lower.

Back to the triangle – all three sides are telling you the same thing. This is a tight oil market set to get tighter, and that means higher oil prices. At some point, that ‘financial market’ for oil may start to take notice.

Copper

Having shown how positive the fundamentals for oil are, could the same be true for an industrial metal such as copper? Let’s apply the “triangle” approach once more.

Most investors will probably agree that the long-term outlook for copper is very bullish. Why? If you decide to switch to an electric vehicle (EV) somewhere down the road, that’s more copper. Switch to renewables – more copper. A larger and more renewables led power grid – more copper.

However, most investors are focused on today’s fears about interest rates and the global economy, rather than tomorrow’s looming demand surge. As with oil, it’s the financial market for copper that drives the price in the short term.

Demand for Copper

China remains by far the world’s largest consumer. Now there’s plenty of reasons to be concerned over the Chinese economy, but the monthly trade data tells us that China’s demand for copper seems to be holding up well. And structurally, this demand seems to be growing much faster than iron ore (Chart E).

Supply for Copper

Even more than with oil, the supply side of the equation is chronically weak. Miners have stopped digging holes in the ground as shareholders have demanded less capital expenditure and more capital discipline. The biggest and best mines have exhausted their best grades, while those few new mines tend to be in difficult political or geological locations (Rio Tinto’s ‘challenges’ with their Mongolian venture would be a perfect example).

We’ve had a 15-year bear market in mining investment, and it’ll take another 10 years from this point on to raise output via new (greenfield) development, even if there was the will and way to do that.

The world’s biggest copper producer is Chile. Copper production has been in severe decline over the last three years due to asset age, geology, and industrial unrest (Chart F). This is an extreme example of a global trend, but Chile is the No. 1 producer. Unlike Saudi Arabia, this is not about a conscious decision to cut production.

Inventory

It’s probably not surprising then that with demand being robust and supply growth weak, inventory levels are historically low. Unfortunately, copper inventory data is a rather murky area as well, with data from China not all that reliable. However, we can draw out some conclusions. If you look just at LME & US inventory (Chart G), it has fallen dramatically in recent years. If we add in one of the more reliable Chinese data points, the pattern remains the same.

With robust demand, weak supply, and critically low inventories, it would suggest a much higher price for copper. As well, given the time lag involved in starting new projects/mines, there would appear to be no short-term solutions. At some point, the spot price will stop reflecting (misguided) fears over current Chinese demand and focus more on a potential looming supply crisis in copper.

For both oil and copper, the building blocks are in place for a multi-year bull market.