Oil - Back in Black

Despite its recent weak economic performance, China’s return to the markets will have an impact on oil going forward.

Key Points:

· Last year’s oil bulls were expecting western sanctions on Russia to drive oil prices higher. Yet, despite this theoretically tough (but weakly enforced) stance, Russian production still found its way to market – with India being one of the main benefactors and contributors to this outcome.

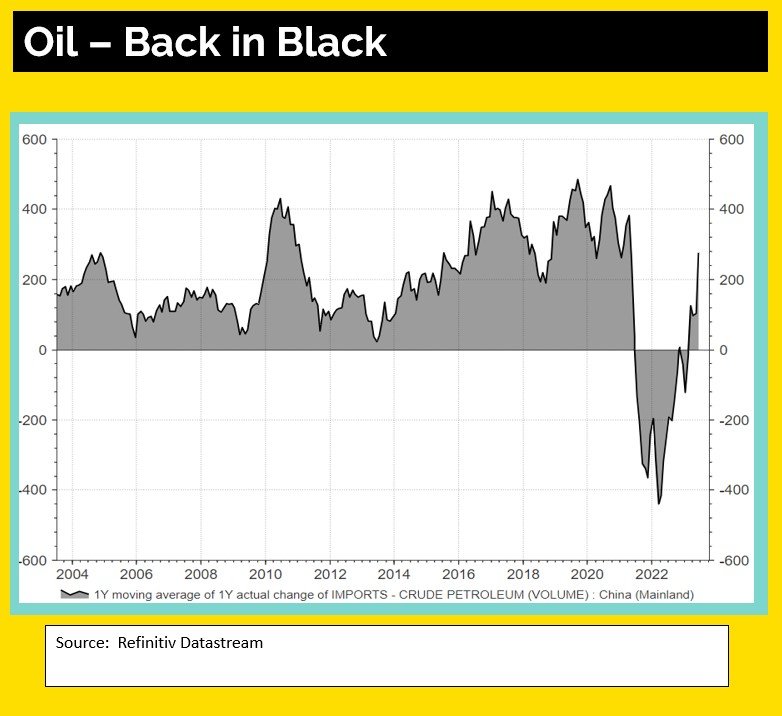

· However, it wasn’t Russian supply that was the major factor impacting the oil market, but demand from China. With two years of declining demand due to Covid lockdowns, in which the second series of lockdowns took crude oil imports from 300k to 400k bbl/day to 200k to 300k bbl/day by 2021 – China’s reduced demand was enough to undermine oil prices.

· Now China is back… and taking advantage of cheap Russian oil. Whatever China’s problems may be elsewhere in their economy, including housing, oil imports are surging. Last month was the highest individual monthly annual increase EVER. The rolling 12m annual change is rapidly heading back towards 300k bbl/day. China is buying Russia’s oil to stockpile, as well as use to export refined products.

· The result – good news for Oil sector share prices, which, in turn, is good news for equity income strategies and thematic sector specialist funds.