Gilts - Time to Stick a Toe in the Water?

Is the Gilt bear market over? It might be seen as tempting given where short term yields are, and that we’ve had some better inflation numbers BUT…..

Key Points:

· While the latest Core CPI print was good, and some of the more aggressive rate rise assumptions are being removed, the key question remains – what will rates be at the end of 2024? Well, to start, maybe higher than people realise.

· The UK remains a low growth economy. There are no easy or palatable policy options to raise the growth rate. At the same time, there are forces in place to keep core inflation sticky for the foreseeable future, whether it be tightening commodity markets (robust demand/weak supply), volatile global food supplies and a tight labour market having to support +2.5m people on long term sick leave.

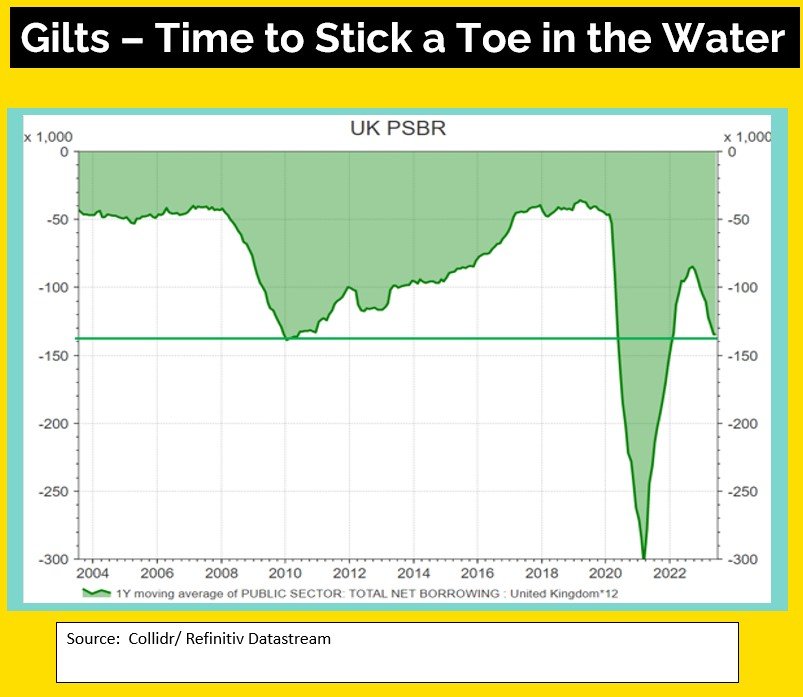

· Meanwhile, we have a very high budget deficit, one that needs funding, so expect Gilt supply to remain elevated for this year, and possibly more.

· The chart to the left represents the rolling 12-month Public Sector Borrowing Requirement (PSBR), an eye-watering £143bn. Which, although significantly below recent periods, is still higher than the £44 billion prior to Covid.

· While a well-managed, diversified portfolio will continually assess different asset classes, and look for opportunities to rebalance the portfolio when appropriate, gilts remain a volatile asset, and money market funds remain a lower risk alternative.