A Solid Foundation to Housing

Despite interest and mortgage rates on the rise again, the housing market remains resilient.

Key Points

· With CPI holding at 8.7% in May, Core CPI at a 31 year high of 7.1%, interest rates now expected to hit 6% by year end, and two-year mortgages above 6%, it may be understandable to compare the housing market to the difficult days of 1992. However, there are reasons to remain reasonably positive.

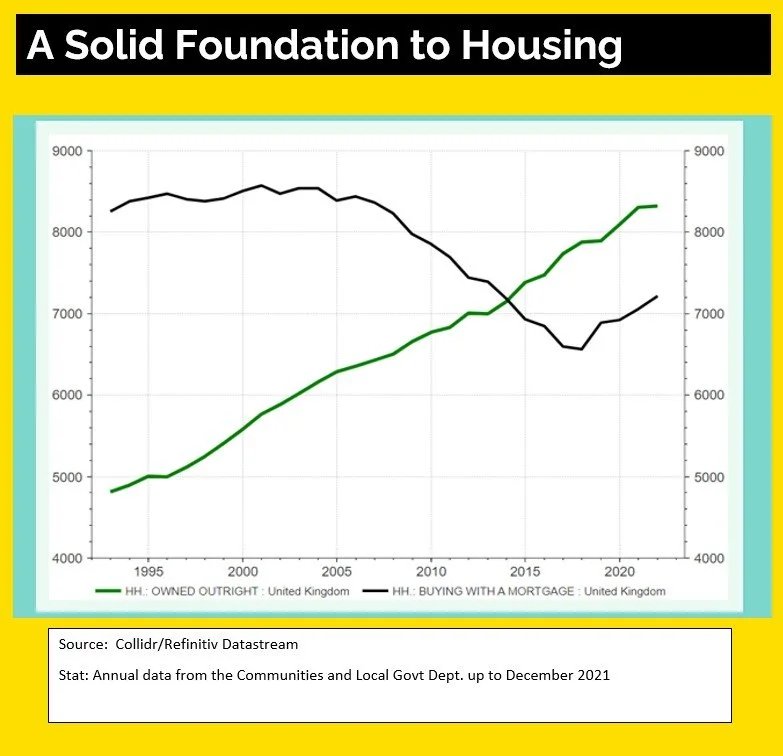

· In 1992, 4.8m households owned their own home outright compared to the 8.3m households with a (mainly variable) mortgage. In 2021 those numbers have become almost reversed – with 8.3m households with no mortgage and 7.2m with a (mainly fixed) mortgage.

· These 8.3m households are net beneficiaries of rising interest rates, whilst for the 7.2m with a mortgage, there is still a sense of delayed misery, for now, as the majority are on fixed deals.

· Today, one major difference in the housing market is a lack of forced selling, so repossession numbers will be much lower than they were in the early ‘90s. Given the recent talks between the Chancellor and the major UK lenders, there’s a strong focus on avoiding this outcome, including a flexible approach to payment terms and holidays. As well, there are much lower levels of negative equity today.

· Supply and Demand – the UK population has grown by more than 10 million people since 1992, while new housing supply continues to fall short of the government’s ambition of 300,000 houses annually

For an increasing number of investors, the biggest challenge may be how best to structure their financial plans if their house is paid off but they need to help their kids on the property ladder – whether that’s through remortgaging options or savings. That’s one area where financial advice continues to remain important