January Commentary

GLOBAL MARKETS

With economic slowdown uncertainties mounting, impacting sentiment, markets reversed course into year-end.

While inflation appears to be slowing, it remains at multi-decade highs, with further tightening likely ahead.

US MARKETS

US equities struggled in 2022, with double-digit negative returns for the year

Despite a rebound earlier in the fourth quarter, US equities had a poor end to 2022, with headline indices producing double-digit negative returns overall for the year. From a sector standpoint, the poorest performers were cyclicals and technology. On a positive note, year-on-year CPI has slowed for five consecutive months, leading the Federal Reserve to raise policy rates less than originally expected by the market. However, PMI figures fell deeper into recessionary territory, forward earnings declined, and with the labour market remaining tight, the cycle of ‘rate-hiking’ may not end in the short-term.

Down -5.9% (US 500)

UK MARKETS

Despite negative returns, the UK outperformed most developed markets in December

The UK declined but comfortably outperformed developed market peers in December. This performance was due, in some part, to index composition, with the FTSE comprised of a higher number of consumer staples and commodity-focused companies, which performed better. However, growth sensitive stocks languished, as PMI’s remained in negative territory but steadied, and yields rose. Inflation remains the key cause of concern, although there are signs that it is reaching a peak. The Bank of England raised interest rates 50 basis points higher, and it’s guidance remains hawkish going into the first quarter.

Down -1.6% (UK All Share)

EUROPEAN MARKETS

Inflation and the war in Ukraine continue to impact the region

European risk assets declined through the month as persistent inflation and the ongoing war in Ukraine remain on the forefront of investors’ minds. Headline stock indices declined but outperformed most developed-market benchmarks. Bonds yields moved higher, and the euro broadly appreciated (except against the Yen). Although PMI’s improved marginally, and near-term inflationary readings are slowing from their recent rampant increases, the Eurozone may likely be in a recession already. Despite this, the ECB raised policy rates 50 basis points higher at their last meeting, and a hawkish Governor Christine Lagarde continues to suggest more increases are to be expected.

Down -3.4% (Euro 600 Index)

JAPAN MARKETS

An appreciating Yen impacts Japanese equity performance

Performance was mixed, as equities saw steep declines in light of a rapidly appreciating Yen. The Japanese domestic market is enjoying stronger earnings results, record levels of share buybacks and less inflationary pressures than their developed market counterparts. Composite PMI’s have moved out of contractionary territory and the government has announced a fiscal package to bolster the domestic recovery seen toward the second half of the year. The Bank of Japan has also moved toward policy normalisation on 10-year bond yields, which has driven domestic currency valuations and investor confidence Down -4.7% (Japan Index)

Key Points

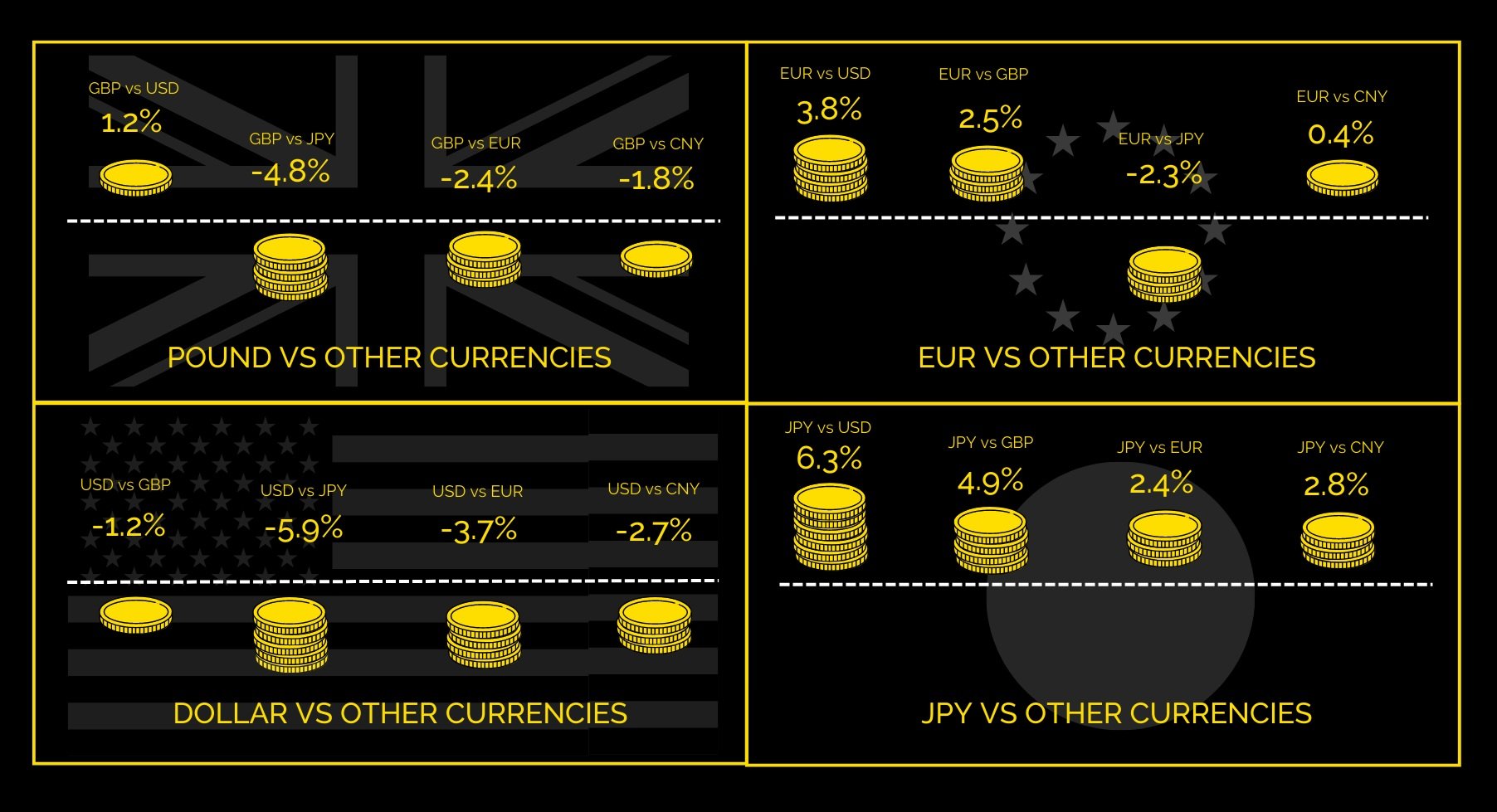

• The US dollar, the best performing major currency of the year, gave back some ground in December, even as traditional assets declined and investor risk appetite soured. Sterling broadly declined against most major currency pairings, except versus the USD.

• The Japanese Yen was the best performing major currency in December, appreciating against developed and emerging currencies alike, owing to a change in monetary positioning from the central bank.

• The euro had another strong month, gaining most against the US dollar and also versus the UK pound, but lost ground to a strong JPY.

• The Chinese yuan appreciated against GBP and USD but was broadly flat against the euro.

Key Points

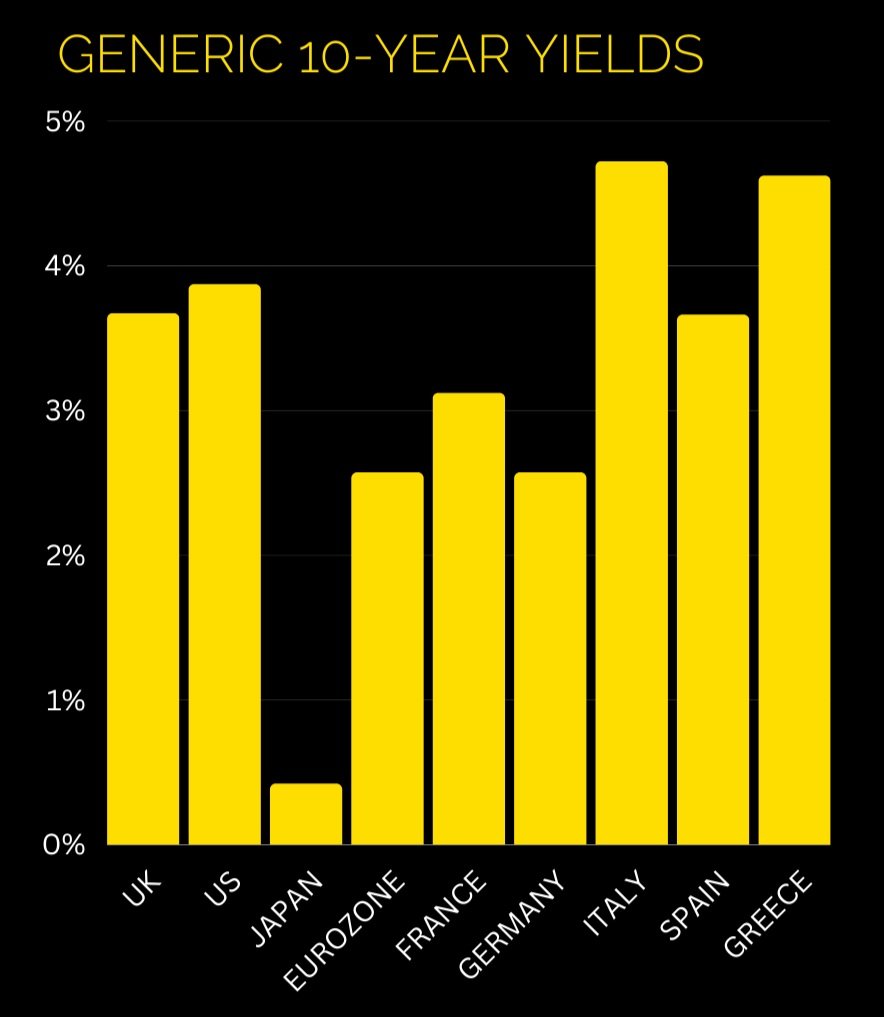

• Global bonds largely declined as yields pushed higher following hawkish guidance from central banks. Investors are positioning themselves for interest rates to be raised and to remain at higher levels for longer.

• In the eurozone and UK, movements on 10-year yields were most substantial. Germany saw their 10-year yield increase 64 basis points, while the UK experienced a 51 basis point move, as respective central banks announced further measures to counter inflation.

• Despite consecutive falling year-on-year US inflation figures and future inflationary expectations (falling 10-year breakeven rates), 10-year yields on nominal bonds rose by 26 basis points. Movements in yields followed increasingly hawkish rhetoric from FOMC members.

• In proportional terms, Japanese yields moved most during the quarter, as the 10-year increased to 0.42% from 0.25%. This was in response to the Bank of Japan reducing its yield curve control program, which was introduced as a deflationary protection measure.

• In the global corporate bond sphere, spreads fell marginally on investment grade and high yield issues. While across emerging market debt, hard currency was largely down while local currency debt appreciated.