April Commentary

GLOBAL MARKETS

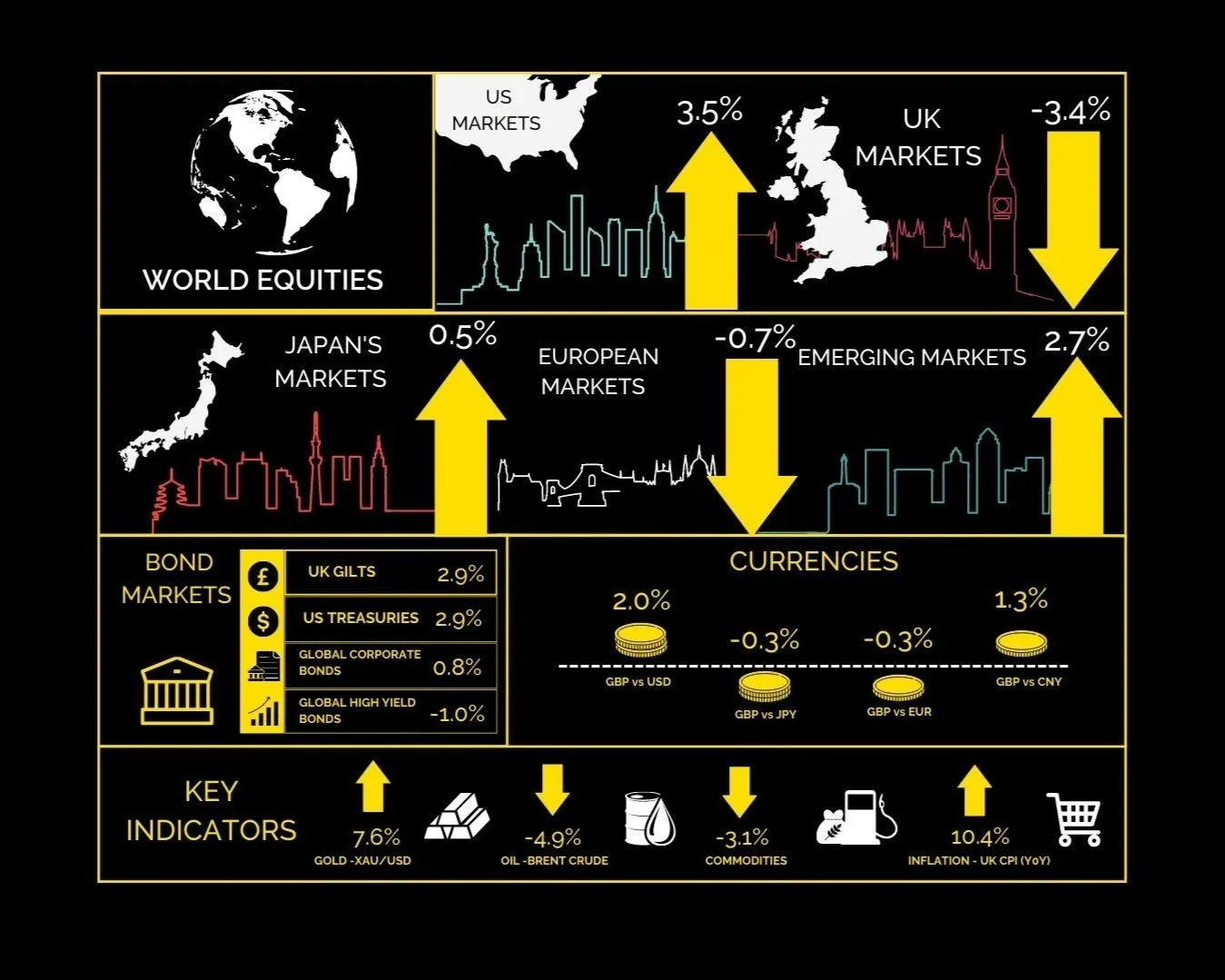

Investors shifted their concern from lingering inflation and geopolitical frictions toward the health of the banking system, as fears of contagion exacerbated deposit flight

US MARKETS

The markets whipsaw on the back of banking sector jitters

US equities had a mixed month but finished the quarter with a rally. Share prices tumbled mid-month as regional banks came under stress following the collapse of technology-focused Silicon Valley Bank (SVB) – the second largest banking failure in US history. They rallied on the coordinated intervention from global policy makers. Yields reflected this changing landscape, declining at the fastest rate for 30 years, and leading to a rally in fixed income assets, as well as a headwind for the dollar. Manufacturing and services PMI’s improved but remain in contractionary territory, and the rate of inflation continues to slow.

Up 3.5% (US 500)

UK MARKETS

Inflation remains stubbornly persistent

UK stocks declined through the month, with the events surrounding SVB in the US, as well as Credit Suisse in Switzerland, impacting financial services. Unsurprisingly the FTSE 350 Banks Index (-13.7%) led the decline alongside consumer-focused sectors. Manufacturing and services PMI’s have deteriorated, and growth expectations have lowered. Despite this, the Bank of England decided to increase the base rate 25 basis points, as inflation moderates but at a frustratingly slow pace. This provided a headwind to relative fixed income performance and equities, but a tailwind to sterling, most notably versus USD.

Down -3.4% (UK All Share)

EUROPEAN MARKETS

Europe underperforms on banking sector woes and ECB rate rise

Europe underperformed global equities, as Germany and France posted respectable returns, but southern states lagged. The most material event was the collapse of Credit Suisse mid-month, which led to a $17 billion loss for bondholders and a rout on European banking stocks – as fears of wholesale deposit withdrawals and collapsing balance sheets permeated. Services PMI’s have continued to improve while manufacturing declined during the month. A 50-bps hike by the ECB also provided support for the euro, which served as a headwind to risk assets in local currency terms. However, policy changes are beginning to take effect and inflation has moderated meaningfully in recent months.

Down -0.7% (Euro 600 Index)

JAPAN MARKETS

Bond and stock markets trade higher

Both the Japanese equity and bond markets traded higher for a consecutive month, albeit while the Yen saw strength versus both developed and emerging currencies alike. Although not insulated entirely from global banking troubles, investors preferred to park capital in a safe-haven jurisdiction with lower sensitivity to the effected institutions. Month-on-month PMIs are improving alongside consumer confidence. Japanese headline inflation has also slowed as a result of the impact of government-sponsored energy subsidies, even though core inflation rose to 3.5% (the highest since 1982). The Bank of Japan decided to leave rates untouched, signalling the end of Governor Kuroda’s tenure.

Up 0.5% (Japan Index)

Key Points

• March saw a month of heightened volatility across currency markets, as central banks intervened to curb inflation and avert a meltdown in the banking system. The net result was the Japanese Yen gained and the US dollar declined the most.

• Driven by actions from the ECB, the euro also had a positive month, only slightly underperforming JPY. A 50-basis point increase in the bank lending rate went ahead to quell price level increases.

• Performance of sterling was more mixed through the month, slightly declining against the Yen and euro, but enjoying strong performance against the US dollar.

• Among emerging markets, the Chinese Yuan lost ground against most developed currency pairs with the exception of the US dollar, while major EM currencies, such as the Indian Rupee and Brazilian Real, followed a similar course

Key Points

• Government bonds had a positive month, as yields declined due to banking sector unease and accommodative action from policy makers. This was in the face of inflation remaining stubbornly high across developed markets, especially within the eurozone and the UK.

• The largest proportionate declines in yields were seen in Japan, Germany and the US.

• Forward looking inflation expectations also declined, as 10-year breakeven rates fell 10 and 19 bps in the US and Germany. In the UK, however, 10-year break-evens marginally rose during the month.

• Yield declines varied across the curve, despite policy rates being hiked – 25 bps in the US and UK, 50 bps in the eurozone – to combat inflation. Future expectations have now softened, with the market pricing cuts in the fourth quarter

• In the global corporate space, high yield bonds expectedly declined as credit spreads spiked and growth expectations soured, whilst investment grade issues rallied as falling yields outweighed the effect of rising credit spreads.