May Commentary

GLOBAL MARKETS

Lingering inflation concerns and banking system jitters continue to stir markets and provide mixed signals for policy makers and global investors alike.

US MARKETS

Markets rise despite a mixed bag of signals on the US economy

US equities traded higher in local currency terms, led by staples and healthcare, and a rebound in financials stocks, as falling inflation and a weakening dollar served as a tailwind to performance. Macro datapoints are more mixed as job openings, factory orders and house prices are declining, whilst business and consumer confidence metrics are picking up, and services and manufacturing PMI’s have notched higher. The trajectory of market movements going forward will likely be data dependent, as the expected softening of both inflation and Federal Reserve policy rate hikes should serve to confirm that the US economy is slowing.

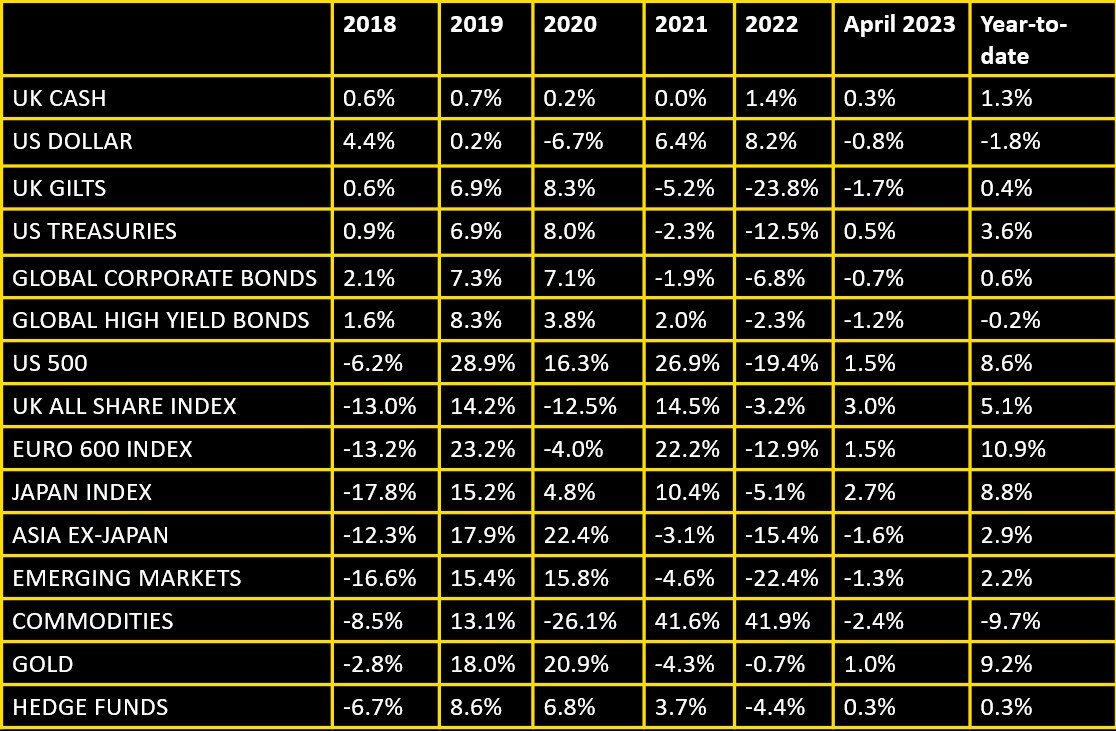

Up 1.5% (US 500)

UK MARKETS

UK markets outperform most major markets

The UK stock market rebounded from a tough March and outperformed developed market peers. As the market gyrated through April, top contributors were those which underperformed last month - banks, real estate and consumer staples companies. Headline inflation has declined but remains stubbornly elevated, not helped by a hot wage print causing yields to push higher intramonth. PMI’s are diverging with manufacturing falling into contractionary territory, while services are in expansion. Interest rates are expected to move higher, and Sterling has continued to strengthen through April from September lows, toward five-year averages..

Up 3.0% (UK All Share)

EUROPEAN MARKETS

Markets anticipating further interest rate increases by the ECB

Developed Europe ex-UK posted strong returns in local currency terms, as Switzerland (+3.0%), Denmark (+2.4%) and France (+2.3%) led the index. All sectors posted gains for the month aside from technology - the top contributors were health care and real estate. Services PMI’s notably improved and GDP saw a marginal uptick, although retail sales fell. Headline inflation has moderated lower, due in part to the base effect and energy price declines; however, core inflation remains sticky. The European Central Bank has reiterated hawkish guidance which has moved yields higher and served to support euro currency strength.

Up 1.5% (Euro 600 Index)

JAPAN MARKETS

A resurgent service economy helping to propel the markets higher

The Japanese market has continued to perform well in local currency terms, outperforming developed equivalents except the UK. Equities continue to appear cheap from a fundamental standpoint, bolstered by recent earnings announcements for the previous fiscal year and positive forward profit guidance from many large companies. Inflation remains elevated versus recent history, but materially below other regions. Manufacturing PMIs have improved and services are in expansionary territory, however retail sales have declined and unemployment has risen marginally.

The Yen depreciated against all major pairs in April as new Bank of Japan governor Kazuo Ueda maintained course with an ultra-accommodative monetary policy agenda

Up 2.7% (Japan Index)

Key Points

• Driven by a steadying of the financials-heavy stock market and forward expectations of BOE rate rises, the UK pound gained most versus safe-haven (USD and JPY) and emerging currencies alike, as April saw sizeable moves across the currency space.

• The euro also had a positive month, marginally under performing sterling, but gaining against major pairs as the ECB President, Christine Lagarde, signalled a more hawkish course to bringing inflation under control.

• The dollar weakened on the back of falling inflation figures and expectations of a Fed pivot on rates later in the year, whilst the Yen declined as the Bank of Japan continued its’ accommodative monetary policy regime under a new governor.

• Across emerging markets, the Chinese Yuan lost ground against most developed currency pairs with the exception of the Japanese Yen, while major EM currencies such as the Indian Rupee and Brazilian Real charted a similar course.

Key Points

•With the exception of the US, government bonds had a negative month due to accommodative action from policy makers, as well as banking sector concerns, as yields edged higher following their decline in March.

• The UK (23 basis points) and France (10 basis points) saw the greatest rise in their 10-year yields, as elevated inflation readings and central bank guidance pushed yields higher.

• In the US, where underlying inflation is slowing at a more meaningful pace and the economy is showing signs of an economic slowdown, yields declined.

• Japan saw 10-year yields edge marginally higher, but little movement expected on nearer dated borrowing rates, while the Eurozone saw the most disparity, where Germany, Italy and France yields rose, while in Greece yields declined.

• In the global corporate bond space, high yield bonds declined ahead of investment grade selections, as rising yields, in tandem with fears of an economic slowdown, permeated.