June Commentary

GLOBAL MARKETS

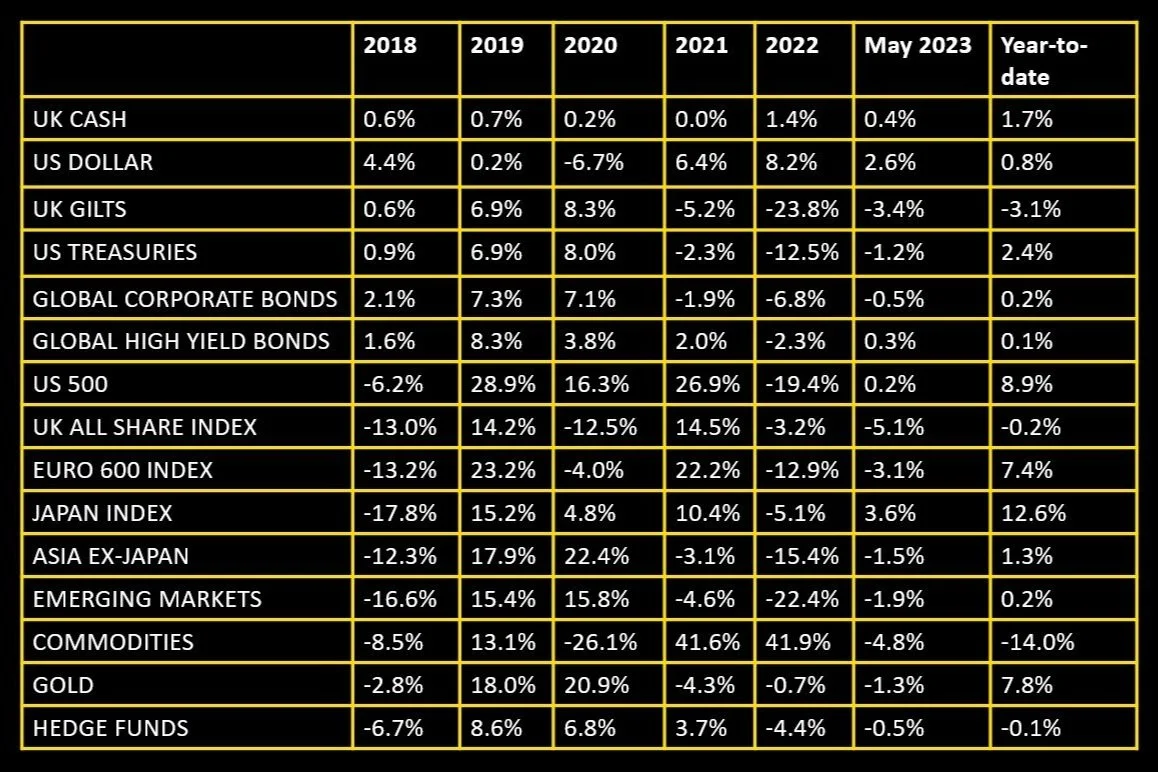

Core CPI sticky in the USA while stubbornly high in the UK. Global macro sentiment remains fragile, with one noticeable exception being in the US large-cap technology sector.

US MARKETS

Mostly driven by a few stocks, with a mixed bag of data impacting overall sentiment

Returns were unusually varied within the US market. Conflicting macro data (stronger employment, weaker PMI activity) and rising bond yields meant that market leadership was mostly concentrated in large cap technology. ‘AI’ was the focus of investor optimism, with one stock, Nvidia, adding U$248bn to its market value, an amount equivalent to 2.5x the entire market cap of BP. Bond markets pared back their assumptions for rate cuts later in the year and a deal to avert a debt default was reached.

Up 0.3% (US 500)

UK MARKETS

Fall despite better than expected economic data

Whilst economic data was generally better than expected, and the IMF and BoE both abandoned their UK recession forecasts, markets were agitated by rising Core CPI inflation, which helped drive Gilt prices lower. Weaker commodity prices and a rotation away from traditionally defined value sectors saw the FTSE100 decline by -5.4%, though the FTSE250 was slightly more resilient at -3.6%. The Oil sector was particularly weak, dropping -11.6%.

Down -5.1% (UK All Share)

EUROPEAN MARKETS

Despite lower inflation data, the markets fell and the ECB remains hawkish

The European Central Bank (ECB) has been tightening monetary policy, but despite lower inflation data (on weaker energy prices), ECB rhetoric remains hawkish. The Eurozone Composite PMI indicated reasonably robust economic output, despite the manufacturing sector's contraction. In local currency terms, long-duration Bund prices rose slightly, while the euro fell against the dollar. Growth stocks outperformed value, and large-cap stocks continued to outperform small-cap. The Technology sector saw strong returns, taking its lead from Wall Street.

Down -3.1% (Euro 600 Index)

JAPAN MARKETS

A period of strong performance continues

The Japanese stock market experienced strong performance, with the Nikkei 225 rising 7.04%, and reaching a 23-year high. Like most markets, growth equities outperformed their value counterparts, and large cap was ahead of small cap. Inflationary pressures, although high by historical standards, remain significantly below the US and European levels, while the Japanese central bank continues to pursue relatively dovish monetary policies.

Up 3.6% (Japan Index)

Key Points

• The global currency markets have been influenced by a variety of factors, including weaker US ISM Manufacturing PMI, stronger job openings, and the recent regional bank failures. The Federal Reserve's interest rate decisions and concerns about inflation have also played a significant role.

• The Sterling/dollar exchange saw a change in fortunes following the strong performance of sterling during the month of April. Risk-off sentiment often helps strengthen the US dollar, with May seeing the Dollar Index increase by around 2.6%.

• Dollar strength reflected a desire for safe haven currencies, based on macro data pointing towards stickier inflation, to suggest a ‘stronger for longer’ path for interest rates.

• On a year-to-date basis, the largest returns have been seen from the GBPJPY (9.22%) and the GBPEUR (3.09%).

Key Points

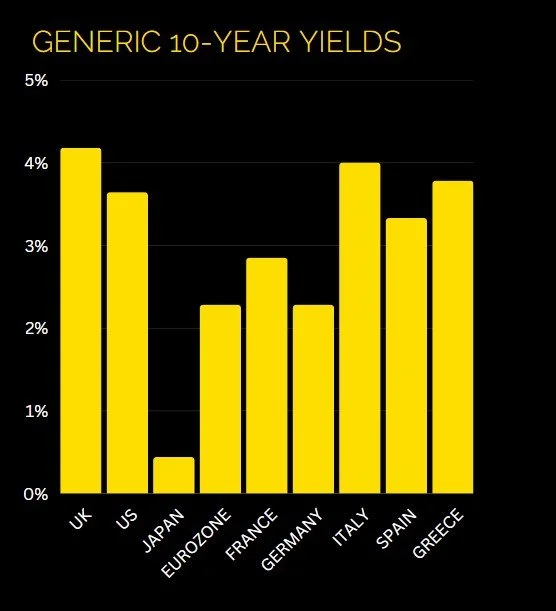

• A very unpleasant print for UK Core CPI at 6.8% was the catalyst for a sell-off in Gilts. Expectations for further rate rises sent UK 1yr Gilt yields up from 4.3% to 4.7%.

• In the US, it was a tale of rate cuts postponed. For stronger jobs data and stickier inflation means that the expectation of rate cuts for later this year has begun to melt away.

• The UK 10 year yield (0.46%) and US 10 year yield (0.22%) rose.

• The US 'yield curve inversion', which is often perceived as a predictor of recessionary periods, deepened again during the month

• Short duration continued to outperform long duration. Fixed income volatility throughout most of May was consistent with the elevated levels witnessed in recent years.