March Commentary

GLOBAL MARKETS

On the back of persistent global inflation and robust US economic data, the markets now expect that developed markets will not cut interest rates until later in the year.

US MARKETS

Continue their upward trajectory

US equities moved higher through February, driven chiefly by gains in the Consumer Discretionary (+8.6%), Industrials (+7.0%), and Information Technology (+6.2%) sectors. Despite the recent cycle of interest rate hikes, the US economy continues to remain resilient and even above expectations in areas, almost expansionary territory, given the recent growth and PMI indicators. The ‘Magnificent Seven’ stocks are increasingly looking like the magnificent three (Nvidia, Meta and Amazon), with Q1 earnings exacerbating this trend. The dollar moved higher in the month, while fixed income has languished year-to-date, with investors now expecting that the Fed will not cut rates until later in the year.

Up 5.2% (US 500)

UK MARKETS

Trailed developed market counterparts

UK stocks trailed their developed market counterparts for the month. On a positive note, the index was led by financials (+3.1%) and industrials (+3.7%). As well, larger cap companies tended to outperform mid and smaller cap equivalents. Following the release of new data, the country had slipped into a technical recession at the tail end of 2023, and Q1 earnings figures have also pointed to a slowdown in company profits. Within the fixed income space, corporate bonds and index-linked selections finished ahead of the broader gilt index, as longer dated yields moved lower, buoying returns.

Down -0.2% (UK All Share)

EUROPEAN MARKETS

Rallied on better inflation data

European equities rallied through the month, but slightly underperformed most developed market peers. Large cap companies finished ahead of mid and small caps. Aided by declines in energy and food inflation, European inflation is trending back toward the long-run ECB target of 2%, albeit at a slow pace. Eurozone services PMI’s improved and the unemployment rate has declined, while, on the other hand, retail sales are falling and business and consumer confidence remains fairly negative. European fixed income was broadly lower as yields rose, and government bonds underperformed their corporate counterparts.

Up 2.4% (Euro 600 Index ex UK)

JAPAN MARKETS

Performed well on multiple fronts

Japanese stocks performed well in yen terms, as both the Nikkei and domestically-focused TOPIX index were positive. Inflation remains elevated relative to the 25-year average, but it is moderating gently back toward the 2% annualised target, with goods and food inflation sharply dropping. The yen continues to depreciate on the back of the continued loose monetary policy stance by the Bank of Japan. This stance has served as both a tailwind to the country’s significant export base, as it has for Japanese bonds, which delivered positive returns in February.

Up 4.9% (Japan Index)

Key Points

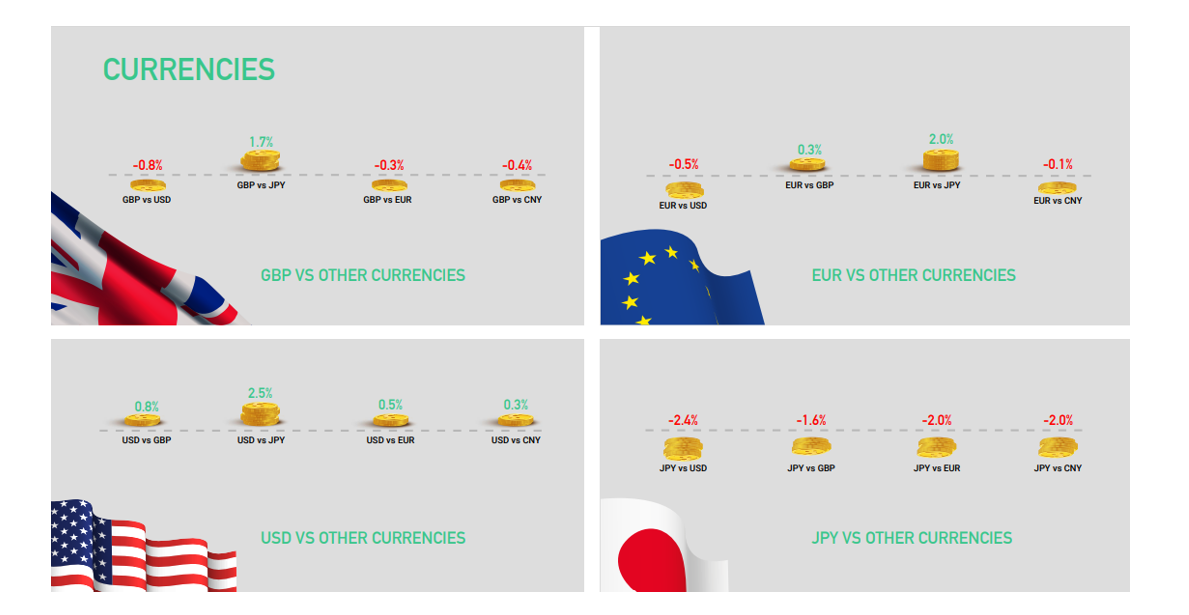

• The best performing major currency in February was the US dollar, which appreciated against all major pairings but most notably versus the Japanese yen.

• In aggregate terms, sterling declined back toward the $1.26 mark at month end, as the UK is still wrestling with concerns over inflation, growth, productivity, and a yawning twin deficit.

• The Japanese yen continued its slide against major currency pairs, ending the month at 150 to the dollar, as the Bank of Japan persisted with its monetary stance and control of the country’s yield curve.

• The euro and Chinese yuan experienced a more mixed performance profile, both lower versus the dollar, but ahead versus the Japanese yen

Key Points

• The bond market was broadly negative in February as inflation concerns continued and yields backed up.

• The largest movements in 10-year yields were seen in the US (+0.34% to 4.25%) and UK (+0.33% to +4.12%). Japan was the only country to see a slight decline on their 10-year yield (down 2 basis points).

• The best performing area of the fixed income space was emerging market debt, which rallied alongside EM equities as general sentiment lightened and the US economic outlook improved. High Yield also posted positive returns, with European issues performing best.

• Despite being led by the US, where growth remains robust and ahead of expectations, investment grade bond indices were negative. While the worst performers were Japan and the UK, which are both facing long-run structural productivity concerns and mounting debt issuance.