UK Elections

Will the Winds of Change Actually Be More of a Breeze

If you believe in what the polls have been showing this year, we are heading for a Labour government at the beginning of July. In fact, they suggest it will be a landslide victory now.

In the last 50 years, Labour have come into power twice: in 1974 and 1997. While on the last occasion Tony Blair may have inherited a strong economy, and an even stronger set of public finances, this time it will be entirely different (as Chart A helps demonstrate). The economy is still dealing with the effects of Covid and a period of high inflation, which has culminated in a significant amount of government borrowing.

In the short term, this will have a profound effect on what Labour will be able to implement and achieve from a policy perspective.

The likely result will be a marginal increase in spending over the current Conservative government, which might come as a surprise to many traditional labour activists and voters. In terms of policy decisions, there are some specific “fully costed” pledges from Labour, including steps on education (e.g. VAT on private school fees), improvements to the NHS, and the creation of Great British Energy (by increasing the windfall tax on North Sea oil and gas).

However, these changes should have minimal impact in the grand scheme of public finances. On the larger aspects – overall government spending, level of taxation, size of the budget deficit – it is likely little will change.

Compared to our major European trading partners, the UK is running at an uncomfortable combination of high budget and current account deficits, which may limit the next government’s ability to make significant changes to public finances (Chart B).

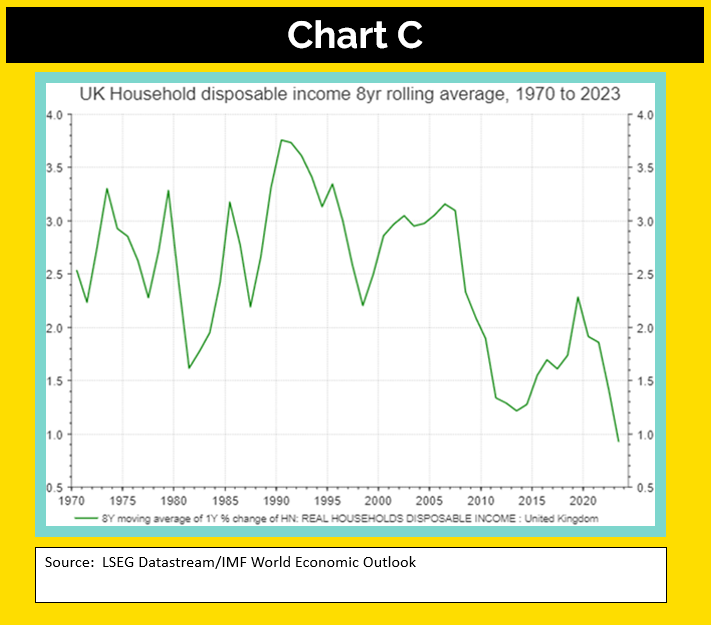

However, in reality, the electorate are probably more concerned with how policy decisions will impact them personally, as well as financially. We have become used to sustained, persistent improvements in our standard of living. Even during the 1970’s, which is often viewed as a difficult financial period for the UK, household disposable incomes were growing at around 2.5% per annum.

Yet, since the financial crisis of 2008, incomes have grown at a much slower rate, and over the last 8 years, barely at all (Chart C). Post election, the new government will need to find a way to stimulate growth and improve the economy, all while trying to balance the books with a higher deficit. It’s not going to be easy.

For now, the markets appear to be pricing in this dilemma. One only needs to look at recent history to see how markets respond to ‘unannounced’ and ‘unfunded’ tax cuts. The Labour government will be wise to heed this experience.

While there may be some surprises when the budget, pencilled in for September, finally arrives, the election result appears to be already priced in.

So what can we expect?

As with all politicians, you need to read between the lines. Promises of no tax rises for ‘working people’, leaves enough wriggle room for taxes on a number of other sources – including capital gains, rental income, dividends, pensions, etc – without contravening this pledge. Difficult choices, no doubt, lie ahead, but in the short term there is likely to be a strong feeling of continuity.

Here are a few observations on how this may impact client portfolios:

· Typically most well-managed mandates invest using a genuine global perspective. From this, the UK has a modest allocation in nearly all global equity indices. There is generally no real home bias in most portfolio allocations, so proper geographical diversification remains the key.

· This is a year of elections. The investment processes deployed by Spring are designed to look through political noise, chatter, and market speculation, and ensure we remain evidence and data driven wherever possible, to avoid injecting our own behavioural biases.

· Our proprietary signals are currently pointing towards a continued ‘risk-on’ environment. The all-time highs recently witnessed in the US, Japan, Europe and UK equity markets are a vindication of this position.

· Correlations between asset classes, particularly between equities and fixed income, remain at elevated levels. This means that investors should take more care over how they attain a properly diversified portfolio, including investments in fixed income.

· We have a positive attitude towards UK large cap and UK equity income strategies, as well as being positive on other markets and sectors, e.g. the US, global technology, Europe, and select commodities. A global, diversified approach has been beneficial so far this year.

· Spring’s investment processes are designed to look through political inflection points. We are unlikely to change our view based on this election result, especially since a Labour government seems likely. We will remain vigilant to the possibility of political ‘surprises’ impacting the markets, especially any increased volatility in the gilt market.

· Several of the multi-asset and liquid alternative funds available to us are able to make investment decisions that could benefit from rising Gilt yields and weaker sterling. For example, should there be an electoral surprise.

· The use of unhedged share classes, where appropriate, could benefit from any fall in the value of sterling – as was the case in June 2016 following the Brexit referendum result. However, given that there is little uncertainty about these elections, we expect any increase in currency volatility to come from central bank decision making rather than the final election result.

At this stage, we are not expecting a surprise result on election night. For no matter the final result, the economic outlook for the country is unlikely to change dramatically.

From an investment perspective, the perceived continuity of traditional policies helps provide some certainty going forward, removing the political risk, at least in the short term. Investors should continue to invest for the longer term. Naturally, vigilance is required for anything that may change this outlook, but at present, the “winds of change” would appear to be more “steady as she goes”.