April Commentary

GLOBAL MARKETS

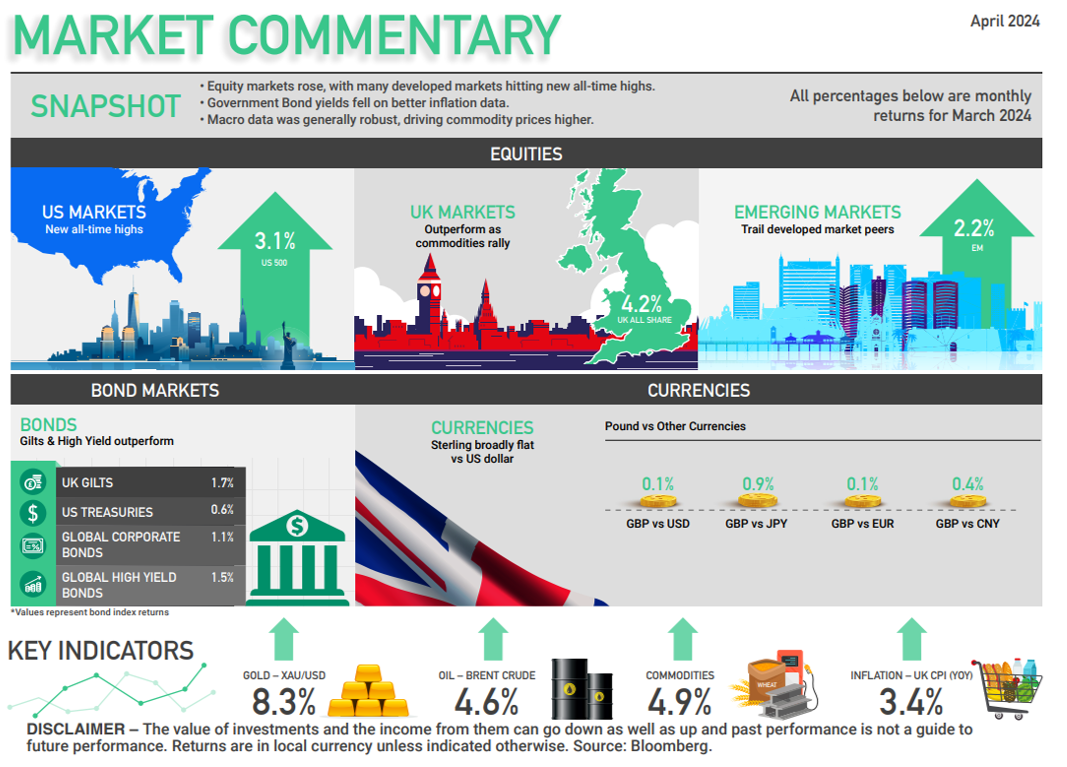

An improving inflation landscape and resilient macro data contributed to a further rally in equity markets, with the US, Japan, and European markets hitting all-time highs.

US MARKETS

Continue to hit all-time highs

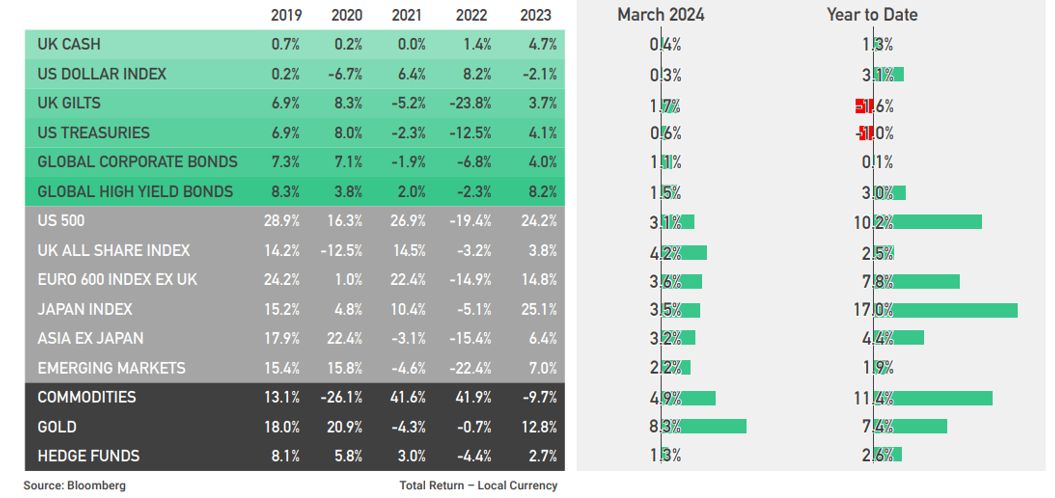

The US markets are at all-time highs, led by small and mid-caps this month, with the Russell 2500 up +3.9%. The Nasdaq was positive, and yet it was ‘value’ stocks outperforming ‘growth’ ones for the month, with the best performing sector being energy. Over the first quarter, the US market has managed an impressive +10.2% return. Inflation continued to moderate in March, while recent strong economic data has dampened market expectations for rate cuts. The markets seem to anticipate a “higher for longer” interest rate narrative.

Up 3.1% (US 500)

UK MARKETS

Catching up to developed market peers

UK equities broadly followed global trends, albeit with the recognition that they have trailed developed markets for a sustained period, most notably the US. A strong rally in commodities meant large index heavyweights, such as BP (+7.6%) and Shell (+6.8%), outperformed, while mining stocks also fared well owing to this tailwind. The market also saw a steady stream of corporate acquisition offers and activity (for example, Wincanton, DS Smith, Spirent) despite confirmation that the UK has been in a technical recession. Sterling appreciated versus major currency pairs, while Gilt yields declined on the back of better inflation data.

Up 4.2% (UK All Share)

EUROPEAN MARKETS

Followed other markets in delivering all-time highs

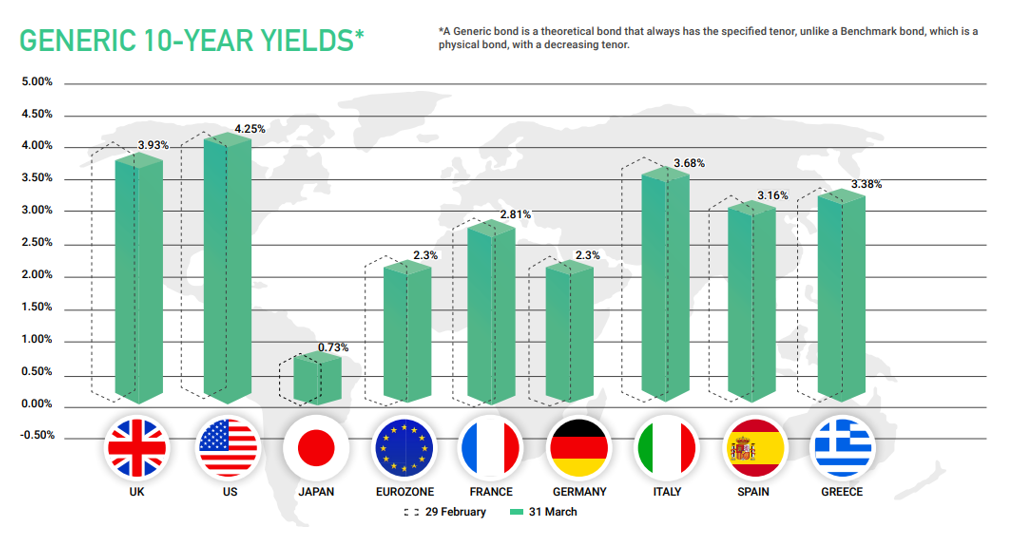

European equities followed other developed markets, hitting new all-time highs. Of all the major developed markets, Europe saw the biggest outperformance of ‘value’ versus ‘growth’ stocks. Economic data was not particularly encouraging, particularly in Germany, where 4Q23 GDP was -1.1% on an annualised basis. The French budget deficit also came in significantly larger than expected. But European markets were buoyed by gains elsewhere, and expectations are that the ECB will start to reduce interest rates. Eurozone bond yields fell, with German 10yr yields dropping from 2.41% to 2.30%.

Up 3.6% (Euro 600 Index ex UK)

JAPAN MARKETS

First positive rate increase in years could not slow the markets

Japanese equities hit a new all-time high, with the Nikkei breaking through the 40,000 barrier and building on February’s gains, in which it had eclipsed the previous peak set in 1989. As was the case with other developed markets, ‘value’ stocks outperformed ‘growth’ stocks. The Bank of Japan raised its headline policy rate for the first time since 2016, thus formally exiting a period of negative interest rates for a country which implemented its first positive rate increase in nearly two decades. This move was anticipated by markets and as such did not have a significant impact on currency or bond markets.

Up 3.5% (Japan Index)

Key Points

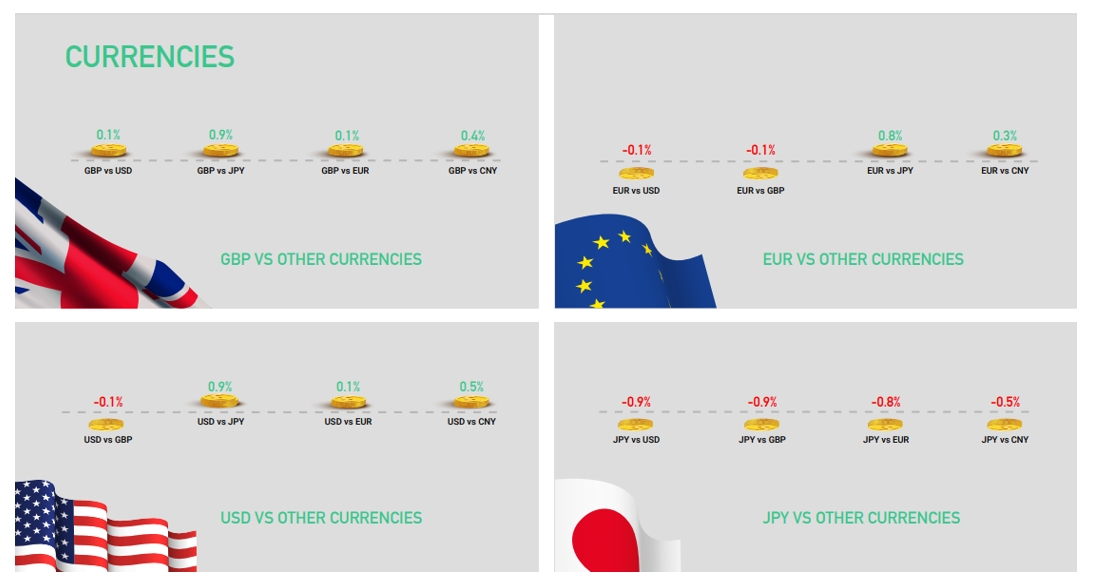

• Tough language from the Fed, and robust macro data, helped to reinforce the expectation of ‘higher for longer’ on interest rates. This allowed the US Dollar to hold onto the gains from earlier in the quarter.

• The Bank of Japan increased its policy rate for first time in two decades, which had largely been anticipated by the markets, and therefore there was little movement in the yen vs. other major currency pairings.

• Sterling was broadly flat for the month versus the US Dollar, closing at U$1.263. Sterling did rally early in the month, but then gave up those gains as the dollar strengthened.

• Sterling was also flat against the euro, month on month, finishing unchanged at £0.855 to the euro. It has traded across a tight range of 0.85 to 0.87 over the last several months.

Key Points

• Year-on-year UK inflation data improved, helped by higher data points from last year dropping out of the calculation, with rate cut expectations improving slightly. Gilts and Index linked bonds rallied, but volatility remained high.

• In the US it was another month where underlying inflation data suggested modest progress was being made, yet stronger macro data meant markets continued to price in ‘stronger for longer’ interest rate expectations.

• The US 'yield curve' remained deeply inverted and has been for a record time period.

• Global High Yield and short duration UK Corporate had another month of positive returns.

• Historically high deficits in most developed markets, as well as high debt/GDP ratios, do not seem to be a focus of concern for the markets.