November Commentary

GLOBAL MARKETS

Global markets suffered a broad-based downturn, driven by US election-related uncertainty and potential policy shifts. Developed markets outperformed emerging, while growth stocks outpaced value.

US MARKETS

Declined despite positive economic indicators and data

US equities fell despite positive economic indicators. The September labour market report exceeded expectations, revealing an increase of 254,000 nonfarm payrolls and a decrease in the unemployment rate to 4.1%. Additionally, year-over-year wage growth was reported at 4%. The initial estimate for third-quarter GDP growth in the US indicated an annualised rate of 2.8% quarter-on-quarter, suggesting above-trend economic expansion. As the earnings season began, the banking sector reported strong results. However, guidance from technology companies was mixed, especially concerning semiconductor demand, which contributed to general market volatility and a decline in overall earnings momentum.

Down -1.0% (US 500)

UK MARKETS

UK budget finally revealed

UK equities fell, with large-cap stocks outperforming small and mid-caps. The labour market remained tight, with the unemployment rate dropping to 4.0% and pay growth at 4.9% year-on-year in August. Inflation decreased significantly to 1.7%, while core inflation was at 3.2%. The UK budget revealed higher-than-expected borrowing and taxes, as Chancellor Rachel Reeves announced £70 billion in extra spending over five years, funded by £40 billion in tax increases and £32 billion in additional borrowing. She indicated a loosening of fiscal rules to permit this increased borrowing, which the Office for Budget Responsibility warned could hinder long-term growth.

Down -1.8% (UK All Share)

EUROPEAN MARKETS

Declined overall despite mixed constituent economic results

European equities declined in October. The eurozone economy grew by 0.4% in Q3, double the previous quarter's rate and above the 0.2% estimate. Germany's economy expanded by 0.2%, avoiding recession, while France and Spain also saw stronger growth. However, Italy's economy stalled. September inflation was revised down to 1.7% but rose to 2.0% in October, largely due to energy effects. The European Central Bank (ECB) noted weakening momentum, especially in manufacturing, although the service sector remained robust. As a result, the ECB announced a third 25 basis point rate cut this year, lowering the deposit facility rate to 3.25%.

Down -3.3% (Euro 600 Index ex UK)

JAPAN MARKETS

Outperformed most developed market peers

Japanese stocks emerged as the top performers despite concerns regarding the potential impact of tighter monetary policy and a stronger yen on export-oriented companies, along with political uncertainty stemming from recent election results. Core inflation for October was reported at 1.8% year-on-year, bolstered by positive wage growth. In its October meeting, the Bank of Japan (BoJ) maintained its current policy stance, as anticipated, but adopted a generally hawkish tone.

Up 1.9% (Japan Index)

Key Points

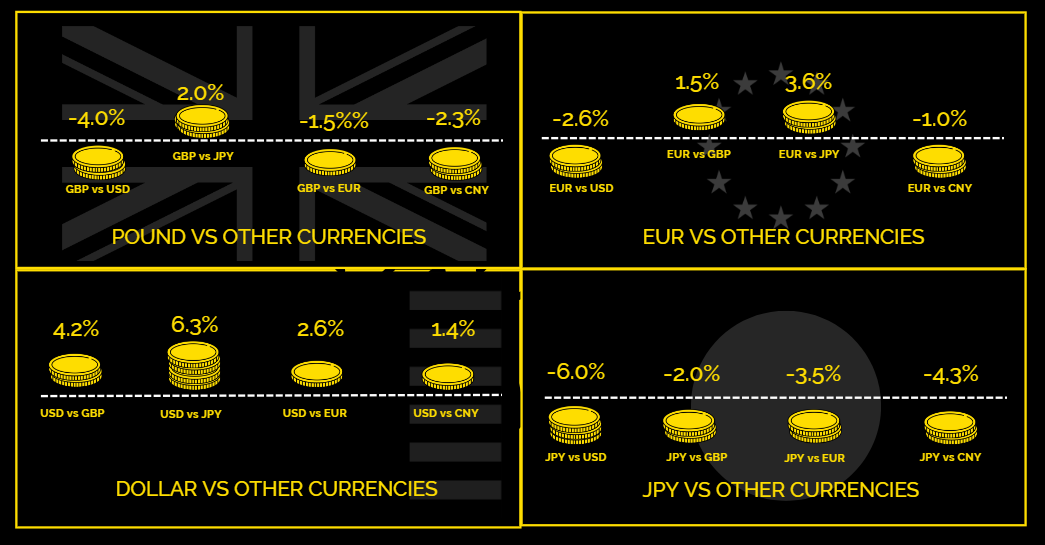

• Due to its economic strength and divergence among major global central banks' pace of interest rate cuts, the US dollar strengthened against major currencies. Positive economic data has lowered expectations for Federal Reserve rate cuts, pushing up yields.

• Sterling weakened after the new British finance minister, Rachel Reeves, announced a tax-and-spend budget that raised market concerns about inflation and growth.

• The yen weakened against the dollar and will remain pressured this year, as Japan’s ruling coalition’s election loss raises political and policy uncertainty. Japan's near-zero rates versus rising U.S. rates continued to weigh on the yen.

• The euro weakened sharply against the dollar on rising speculation of a Trump victory, as his policy proposals hint at a return to US protectionism that could shift global economic dynamics.

Key Points

• Due to stronger-than-expected borrowing and spending levels now planned, Gilt yields rose following the UK budget announcement, which put pressure on the UK gilt market.

• US Treasury yields rose as cooling rate cut expectations, alongside election uncertainty, pushed 2-year and 10-year Treasury yields above 4.0%.

• European sovereign bond yields rose as traders anticipated increased fiscal spending in the US and UK. High Yield bonds outperformed, supported by expectations that the ECB's easing cycle would benefit a range of fixed-income assets.

• Currency helped credit register positive sterling returns, outperforming gilts.