September Commentary

GLOBAL MARKETS

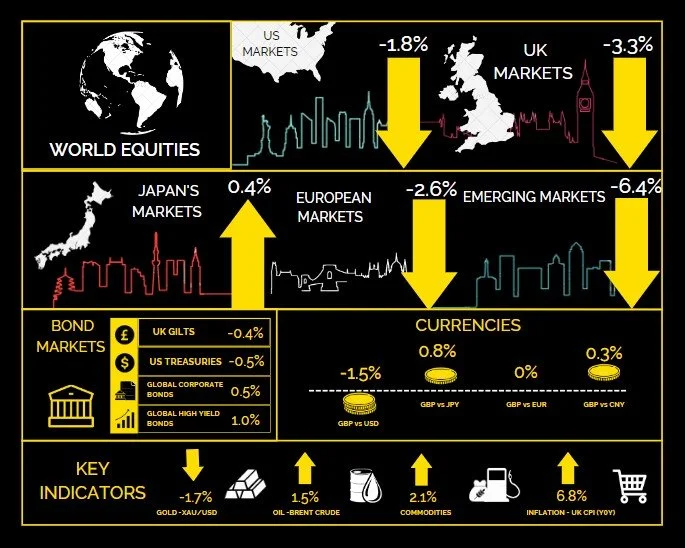

Hawkish central banks and weak Chinese data weighed on global equity markets before a tech-led rally occurred at the end of the month, while government bond yields drifted higher

US MARKETS

Despite overall falling markets, US equities managed to outperform their global peers

Better core inflation data and a generally resilient macro-economic backdrop failed to stop a sharp equity market correction, which bottomed on 18th August, before a late tech-led rally erased most of the losses for the month. AI stock darling NVIDIA was up nearly 6%. Most of the weakness was in small cap stocks, particularly in ‘value’ oriented ones. Inflation data continued to improve, some significantly so, but the language used by the Federal Reserve remained generally hawkish. US 10yr yields moved up, while the US dollar was strong. West Texas Intermediate (WTI) crude oil was up for the month.

Down -1.8% (US 500)

UK MARKETS

Weak first half followed by a late month rally

UK equities mirrored global trends, with a weak first half followed by a late month-end rally. However, returns lagged other developed markets. Unlike the US, there was little difference in performance across the market cap spectrum. Despite better inflation data in the previous month, August showed more modest progress. That, and concerns over the scale of future gilt issuance levels, as well as a continued hawkish tone from the Bank of England, saw short term Gilt yields move higher, with 2yr Gilt yields moving up from 4.99% to 5.16%.

Down -3.3% (UK All Share)

EUROPEAN MARKETS

Declined on weak macro-economic data

European equities declined, with oil and gas and large cap value outperforming the broader index. In sharp contrast to the US, and even the UK, macro economic data continued to disappoint, coming in below expectations. The outlook for the German economy is particularly subdued, with GDP for the 3rd quarter of 2023 looking increasingly likely to be negative. Despite evidence of weaker inflationary pressures, the European Central Bank (ECB) continues to use generally ‘hawkish’ language. However, falling energy costs are starting to feed through into lower input prices.

Down -2.6% (Euro 600 Index)

JAPAN MARKETS

Benefited from strong performances in the utilities and energy sectors

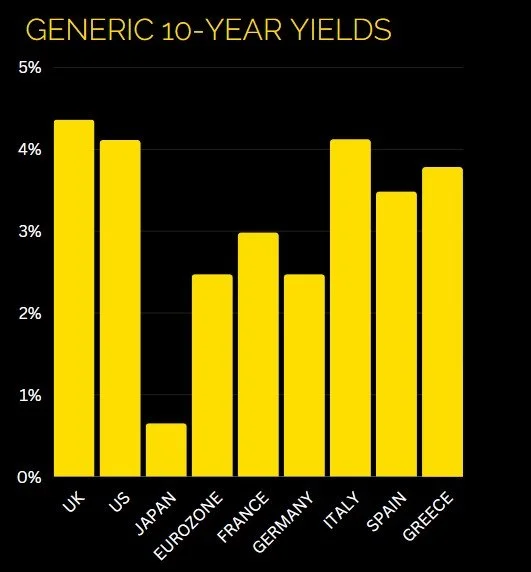

In local currency terms, the Japanese equity market was in positive territory, benefitting from a strong performance in the utilities and energy sectors, as well as tailwinds from a weakening domestic currency. The Japanese Central Bank modified its yield management policy late in the previous month which led to a significant upward movement in bond yields. Yields continued to drift higher during August, with 10yr bond yields reaching 0.64%, the highest level since 2014. Japan is a meaningful constituent of the Global Bond Index from a country perspective.

Up 0.4% (Japan Index)

Key Points

• Tough language from the Fed, and an expectation of ‘higher for longer’ on interest rates, saw strong gains for the US dollar index (an index tracking the relative value of USD versus main currency pairs).

• Sterling weakness versus the US dollar was as much about US dollar strength as any UK specific issues.

• The Japanese Yen was particularly weak, but this reflected to some degree a reversal of its gains from the previous month.

• Macro economic concerns and an underwhelming market reaction to China’s policy response saw further weakness in the Chinese Yuan. Year-to-date it is down -5% versus the US dollar..

Key Points

• Slower progress on inflation and hawkish Bank of England comments saw UK short duration gilt yields move higher.

• In the US, it was yet another month where underlying inflation data suggested progress was being made. But stronger macro data meant markets continued to price in ‘stronger for longer’ interest rate expectations.

• The Barclays Global Aggregate Index, a measure of investment grade debt performance, was negative in aggregate terms. High yield and corporate debt held up better than government bonds.

• The US ‘yield curve inversion’, which is often perceived as a predictor of recessionary periods, remained deeply inverted, but less than it was at the start of the month.

• The big move last month was the large hike in Japanese Government bonds yields. August saw further moves higher and yields remain the highest since 2014.